Are you a victim of credit fraud?

Call us to get expert help at (855) 712-0017.

How to Protect Your Credit

If your information was compromised from a recent data breach, it’s important to act quickly so you can protect your credit from fraud.

Freeze or Lock Your Credit

Why It's Important

A credit freeze (or credit lock) limits access to your credit report, preventing others from opening new credit accounts in your name.

Monitor Your Credit Activity & Reports

Why It's Important

Keep a close eye on your credit card statements and credit report. Unfamiliar transactions or newly opened accounts you didn’t authorize could be warning signs of fraud.

Set Up Fraud Alerts

Why It's Important

Fraud alerts tell creditors to verify your identity before approving new credit in your name. If you’re worried about your compromised information, you can set up fraud alerts with each credit bureau.

Need help?

Aura can easily help you protect your credit and more with our all-in-one digital protection.

Credit Lock vs. Credit Freeze

Credit Lock vs. Credit Freeze

Both credit locks and credit freezes are used to restrict access to your credit report. These terms are often used interchangeably, but there are key differences between them you should know.

Credit Lock

-

Instantly lock and unlock your credit as needed.

-

Provided as a service with other added security features.

-

May cost money for the convenience and flexibility.

Credit Freeze

-

Requires one business day to activate and one hour to deactivate online.

-

Need to contact credit bureaus to add and remove freezes.

-

Free through each of the major credit bureaus.

Both credit locks and credit freezes are used to restrict access to your credit report. These terms are often used interchangeably, but there are key differences between them you should know.

Credit Lock

Instantly lock and unlock your credit as needed.

Provided as a service with other added security features.

May cost money for the convenience and flexibility.

Credit Freeze

Requires one business day to activate and one hour to deactivate online.

Need to contact credit bureaus to add and remove freezes.

Free through each of the major credit bureaus.

Need Help?

Aura can help you instantly lock your Experian credit file and walk you through the credit freeze process for each credit bureau.

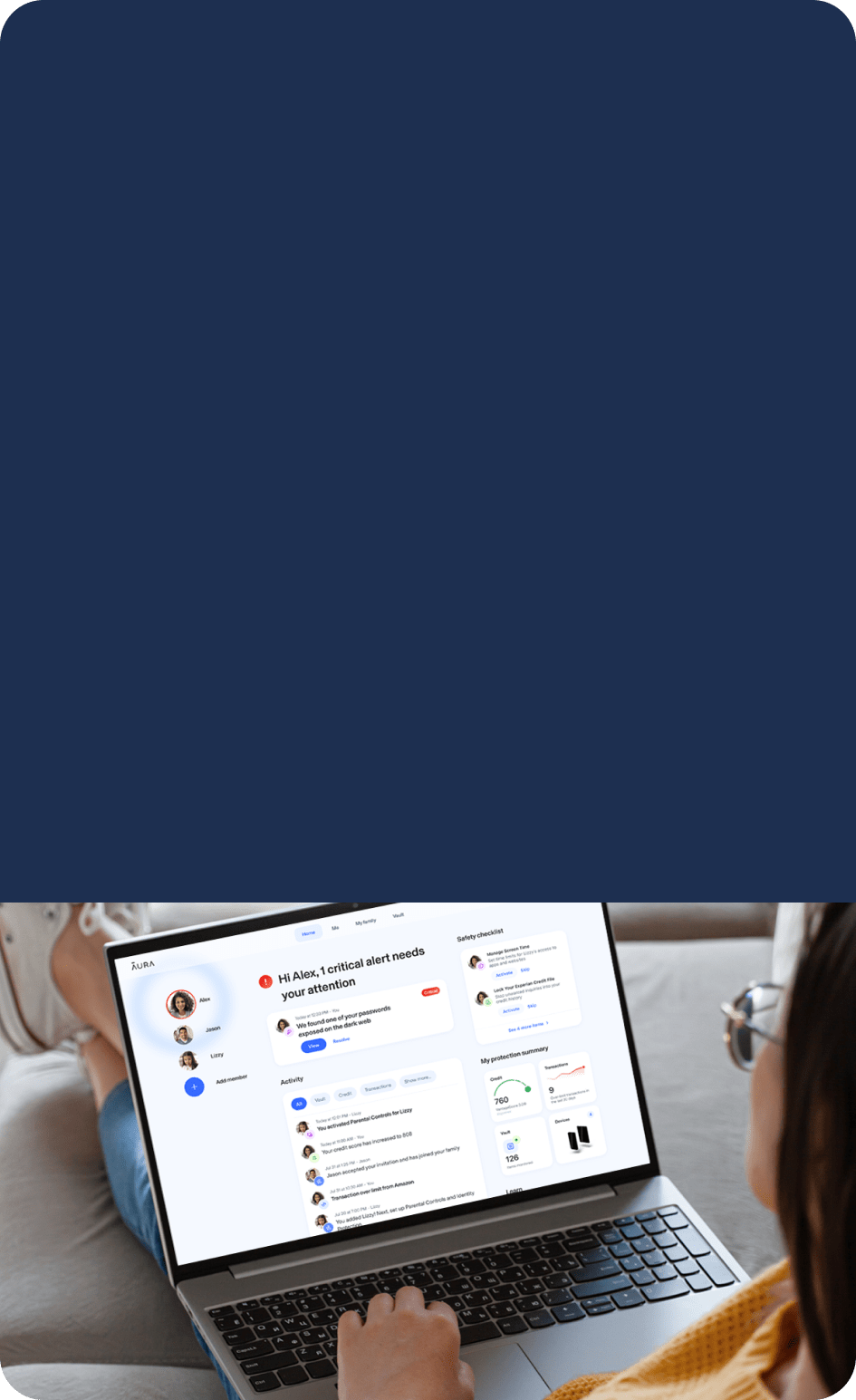

Aura Makes Credit Protection Easy

While the steps above can keep your credit safe, it can take time and energy to keep up. With Aura, you can stay ahead of credit fraud - all in one app.

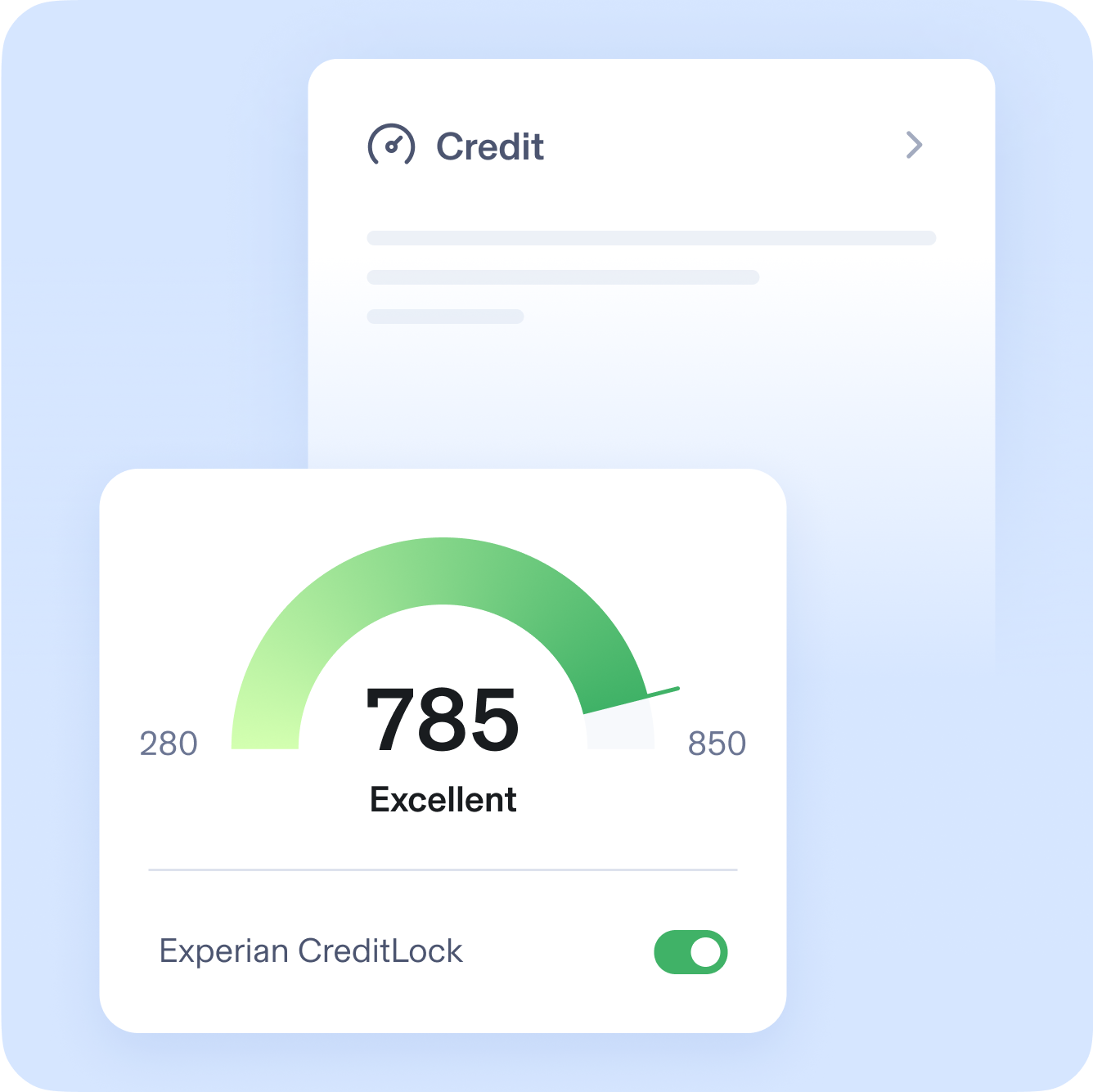

Instantly Lock Your Experian Credit File

With one tap, instantly lock your Experian credit file to stop unwanted inquiries into your credit history. Keep a pulse on your credit health with a monthly credit score¹ and 3-bureau annual credit reports.

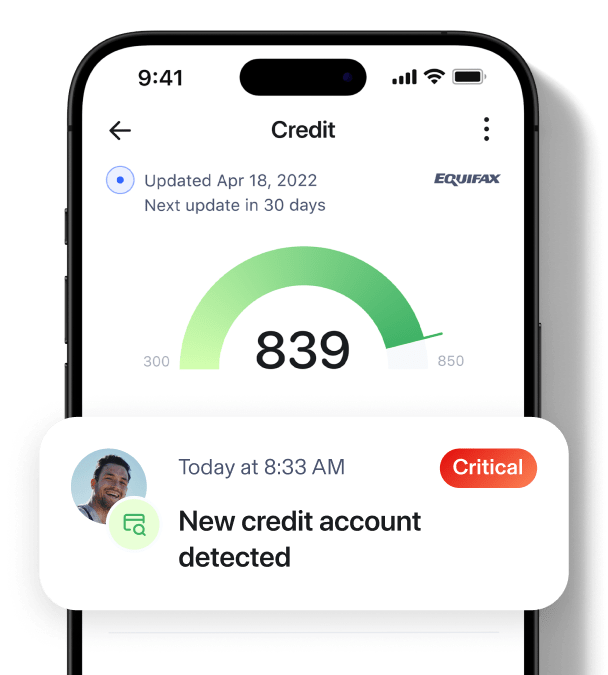

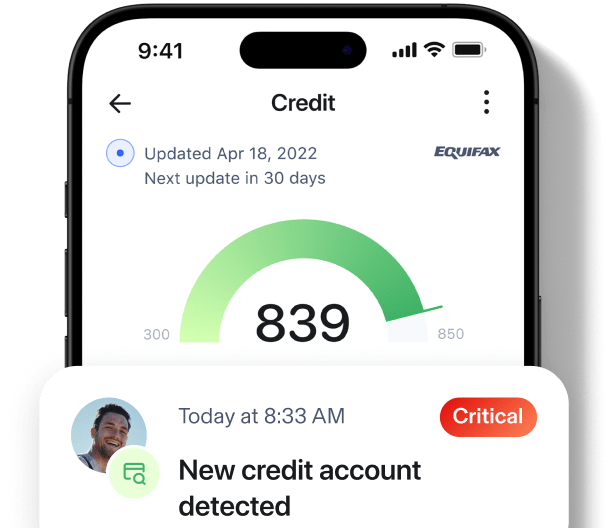

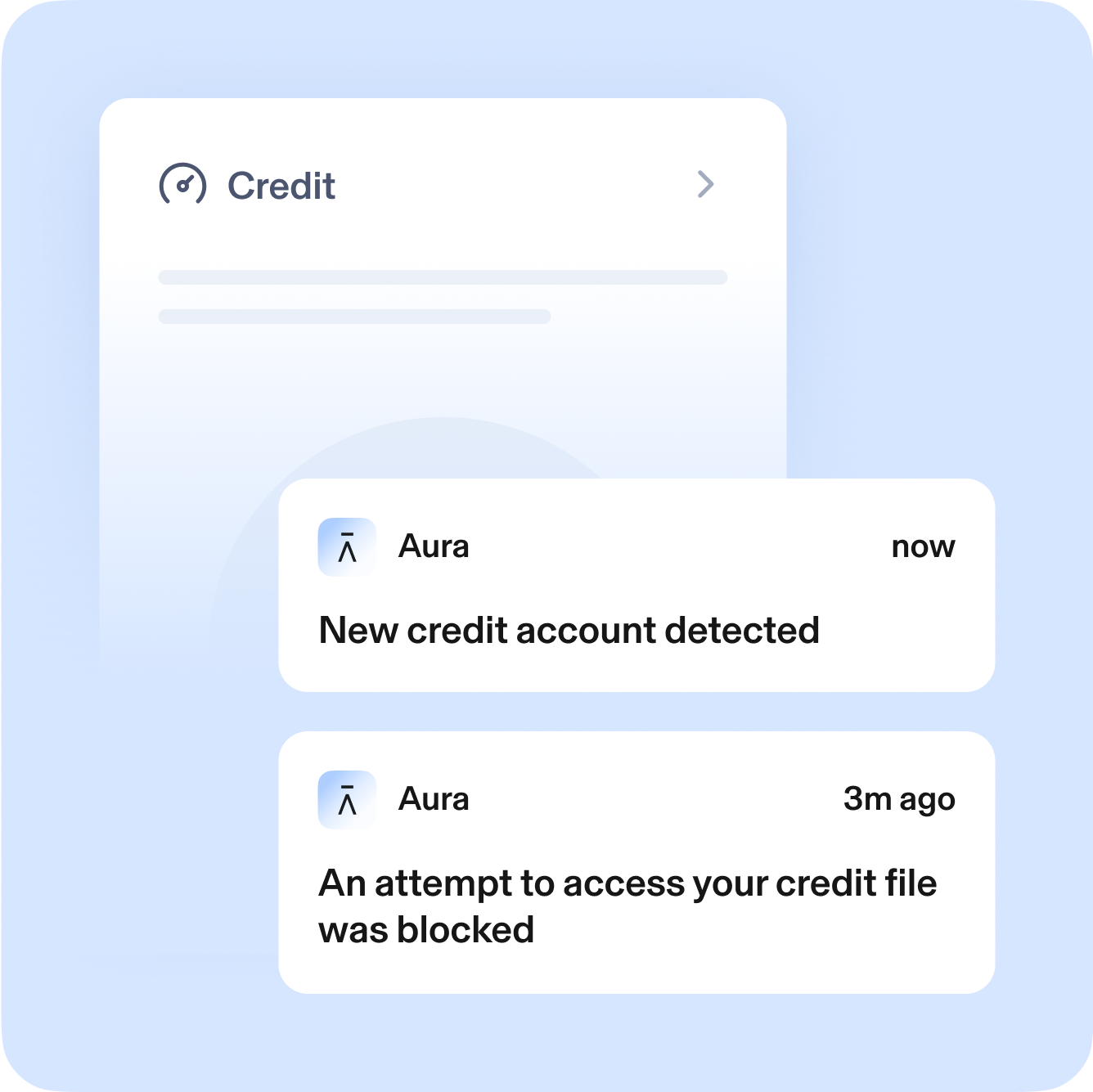

Fastest, Most Reliable Credit Monitoring³

Get alerted to new inquiries to your credit file in minutes, like if someone is trying to open a new credit card or bank loan in your name. Proven to deliver up to 250X faster credit fraud alerts than the competition.³

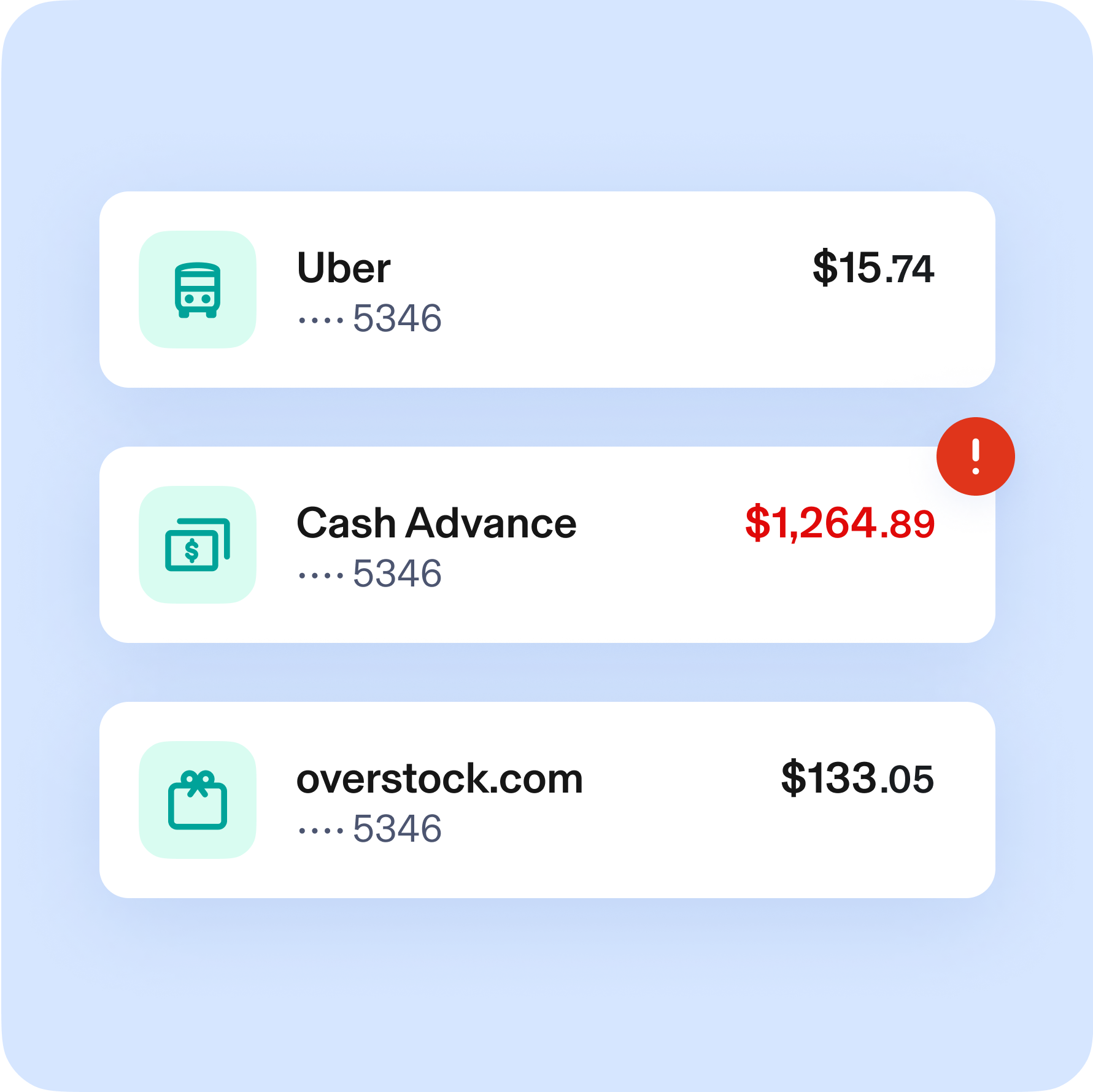

Get Alerts on Suspicious Transactions

Catch early signs of fraud by staying on top of your bank transactions. Link your accounts to Aura, set spending alerts, and we’ll notify you of transactions above your alert thresholds.

Instantly Lock Your Experian Credit File

With one tap, instantly lock your Experian credit file to stop unwanted inquiries into your credit history. Keep a pulse on your credit health with a monthly credit score¹ and 3-bureau annual credit reports.

Fastest, Most Reliable Credit Monitoring³

Get alerted to new inquiries to your credit file in minutes, like if someone is trying to open a new credit card or bank loan in your name. Proven to deliver 250X faster credit fraud alerts than the competition.³

Get Alerts on Suspicious Transactions

Catch early signs of fraud by staying on top of your bank transactions. Link your accounts to Aura, set spending alerts, and we’ll notify you of transactions above your alert thresholds.

Expert Guidance at Every Step

Personalized Guidance

Following a fraud incident, you are assigned a dedicated agent to monitor your credit and collaborate closely with you to file identity theft reports.

Credit Security Advice

Agents provide expert guidance on how to lock or freeze your credit to help protect you against future fraud.

Bank Institution Support

Agents go above and beyond by contacting banks on your behalf to help resolve fraud issues.

Long-Term Follow-Up

Agents will check-in six months after the fraud incident to ensure that the issue has been fully resolved.

Protecting Over 500,000 Happy Customers

“Great security at an honest price! Not only is it a reputable product, but the Customer Service is outstanding!”

“No exaggeration...this was the best customer service I have ever encountered!”

“Took the time and effort to help. Also stopped a thief from stealing my information and opening several accounts even with a bank.”

“It’s really easy to get everything set up and provides peace of mind knowing that your identity is protected.”

“I love how Aura contacts me when anyone accesses my credit report. They let me know when to change my password because of a breach.”

“Great service, always there for you. They monitor and protect just about everything for a reasonable charge.”

“I have nothing, but positive things to say about Aura. The alerts I get when I open a new account let me know that they are monitoring 24/7.”

Individual

Identity Theft Protection

- $1 Million Identity Theft Insurance*

- Account Breach Alerts

- SSN & Personal Info Dark Web Alerts

- Home & Auto Title Fraud Alerts

- Stolen Identity Alerts

- Identity Verification Monitoring

- U.S. Based Expert Fraud Remediation

Financial Fraud Protection

- 3-Bureau Credit Monitoring

- Instant Credit Lock

- Bank Fraud Monitoring

- Financial Transaction Monitoring

- Monthly Credit Score¹

- Annual Credit Reports

Online Privacy & Security

- People Search Sites & Junk Mail Removal

- Antivirus / Anti-Malware

- VPN with Military-Grade Encryption

- Safe Browsing

- Password Manager

Couple

Identity Theft Protection

- $2 Million Identity Theft Insurance*

- Account Breach Alerts

- SSN & Personal Info Dark Web Alerts

- Home & Auto Title Fraud Alerts

- Stolen Identity Alerts

- Identity Verification Monitoring

- U.S. Based Expert Fraud Remediation

Financial Fraud Protection

- 3-Bureau Credit Monitoring

- Instant Credit Lock

- Bank Fraud Monitoring

- Financial Transaction Monitoring

- Monthly Credit Score¹

- Annual Credit Reports

Online Privacy & Security

- People Search Sites & Junk Mail Removal

- Antivirus / Anti-Malware

- VPN with Military-Grade Encryption

- Safe Browsing

- Password Manager

Family

Family Identity Theft Protection

- $5 Million Insurance with Child Identity Theft Coverage*

- Account Breach Alerts

- SSN & Personal Info Dark Web Alerts

- Home & Auto Title Fraud Alerts

- Stolen Identity Alerts

- Identity Verification Monitoring

- U.S. Based Expert Fraud Remediation

- Child SSN Monitoring

- Child 3-Bureau Credit Freeze

Financial Fraud Protection

- 3-Bureau Credit Monitoring

- Instant Credit Lock

- Bank Fraud Monitoring

- Financial Transaction Monitoring

- Monthly Credit Score¹

- Annual Credit Reports

Online Privacy & Security

- People Search Sites & Junk Mail Removal

- Antivirus / Anti-Malware

- VPN with Military-Grade Encryption

- Safe Browsing

- Password Manager

- AI Spam Call & Message Protection

Child Online Protection

-

Parental Controls

- Content Filtering & Site Blocking

- Screen Time Limits & Scheduling

- Pause the Internet

- Online History & Usage Reports

Safe Gaming (Online Predator Alerts)

- In-game Voice & Text Monitoring

- Predator, Scam & Cyberbullying Alerts

- Weekly Gaming Activity Report

© Aura {YEAR}. All rights reserved.

* The Identity Theft Insurance is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits.

** Free trial offer can only be redeemed once per customer. Full access to plan features depends on identity verification and credit eligibility. If you signed up for Aura through a free trial, then your membership purchase date will be the date you signed up for your free trial, and you will have 60 days from the date you signed up for your free trial to cancel and request a refund. If you switched to a new annual plan within 60 days of your initial Aura annual subscription, you may still qualify for the Money Back Guarantee (based upon your initial annual plan purchase date).

Message Protection is iOS only

¹ The score you receive with Aura is provided for educational purposes to help you understand your credit. It is calculated using the information contained in your TransUnion or Experian credit file. Lenders use many different credit scoring systems, and the score you receive with Aura is not the same score used by lenders to evaluate your credit.

² 60-day money back guarantee is only available for our annual plans purchased through our websites or via our Customer Support team. You may cancel your membership online and request a refund within 60 days of your initial purchase date of an eligible Aura membership purchase either through your Aura Account Membership portal or by calling us at 1-855-712-0021. If you signed up for Aura through a free trial, then your membership purchase date will be the date you signed up for your free trial, and you will have 60 days from the date you signed up for your free trial to cancel and request a refund. If you switched to a new annual plan within 60 days of your initial Aura annual subscription, you may still qualify for the Money Back Guarantee (based upon your initial annual plan purchase date).

³ As compared to the competition. Results based on a 2025 mystery shopper consumer study conducted by ath Power Consulting. ath Power Consulting was compensated by Aura to conduct this study.

⁴ Child members on the family plan will only have access to online account monitoring and social security number monitoring features. All adult members get all the listed benefits.

‡ FBI Internet Crime Report, 2023

⁶ Forbes: “Google Registers Record Two Million Phishing Websites In 2020”

⁷ Rated #1 by IdentityProtectionReview.com as of Dec. 2021.

No one can prevent all identity theft or monitor all transactions effectively. Further, any testimonials on this website reflect experiences that are personal to those particular users, and may not necessarily be representative of all users of our products and/or services. We do not claim, and you should not assume, that all users will have the same experiences. Your individual results may vary.

†